The global market is booming, and businesses are expanding their reach beyond borders. But have you ever wondered how to securely and efficiently process transactions from customers worldwide?

The payment gateway market is expected to reach a value of $106.4 billion USD by 2030, underscoring its critical role in facilitating international transactions. A reliable payment gateway is essential for businesses to capture and transmit customers’ payment information securely.

Selecting the right payment gateway can significantly impact a business’s ability to process transactions efficiently. This guide on Bizansy.com will explore the top five payment gateway solutions and help international businesses make informed decisions when choosing a gateway that aligns with their specific needs.

Understanding International Payment Gateways

International businesses face unique challenges when processing payments across borders, making specialized payment gateways a necessity. One of the primary issues is the higher transaction failure rates and customer abandonment due to the lack of localized payment methods.

What Is an International Payment Gateway?

An international payment gateway is a service that enables businesses to accept payments from customers worldwide, supporting multiple currencies and payment methods. It acts as a bridge between the merchant’s website and the financial institutions that process payments, ensuring secure and efficient transactions. By offering a range of payment options, businesses can cater to diverse customer preferences, enhancing their overall shopping experience.

Why International Businesses Need Specialized Payment Solutions

Specialized payment solutions address the challenges faced by international businesses by providing multi-currency support and localized payment options. Research has shown that offering local payment methods can significantly increase conversion rates and customer satisfaction in international markets. By reducing payment friction, businesses can improve the overall customer experience, leading to increased sales volume. Moreover, these solutions help businesses navigate complex international regulations and compliance requirements, ensuring that transactions are processed securely and in accordance with regional standards.

Key Features of Effective Online Payment Gateways for International Businesses

International businesses require online payment gateways that provide a range of features to facilitate smooth transactions across borders. These features are crucial for businesses looking to expand their global footprint and cater to diverse customer needs.

Multi-Currency Support

A key feature of effective online payment gateways is multi-currency support. This allows businesses to accept payments in various currencies, making it easier for customers to complete transactions in their local currency. By supporting multiple currencies, businesses can reduce conversion rate issues and enhance the overall customer experience.

Local Payment Method Integration

Another important feature is the integration of local payment methods. Different regions have preferred payment methods, and businesses must be able to accommodate these preferences to maximize their reach. By incorporating local payment options, businesses can increase trust and conversion rates among their international customer base.

Security and Compliance Standards

Security and compliance are paramount for international payment processing. Effective online payment gateways must provide robust security features, including encryption, tokenization, and fraud detection systems, to protect sensitive customer information. Compliance with standards such as PCI DSS, GDPR, and regional data protection regulations is also essential. By adhering to these standards, businesses can mitigate the risk of fraud and build trust with their customers. Furthermore, a reliable payment gateway helps businesses navigate the complex landscape of international financial regulations, ensuring that they remain compliant across different regions.

Key security measures include anti-fraud tools that are particularly important for international transactions, which are often at a higher risk of fraud compared to domestic payments. By implementing robust security measures, businesses can protect their reputation and foster customer trust across global markets.

Stripe: The Developer Friendly Global Solution

Stripe

With its robust infrastructure and user-centric design, Stripe stands out as a premier choice for businesses seeking to expand their global reach. Stripe’s platform is engineered to simplify international payment processing, making it an ideal solution for businesses of all sizes.

Features and Capabilities

Stripe offers a comprehensive suite of features designed to facilitate seamless international transactions. Its capabilities include advanced fraud detection, customizable checkout flows, and support for multiple payment methods. This versatility enables businesses to tailor their payment processing to meet the specific needs of their global customer base.

The platform’s robust API and extensive documentation make it a favorite among developers, allowing for easy integration with existing systems. Additionally, Stripe’s support for subscription-based models and recurring payments further enhances its appeal to businesses with diverse revenue streams.

International Coverage and Currency Support

Stripe supports over 135 currencies and has a significant presence in numerous countries worldwide. This extensive coverage allows businesses to accept payments from a broad customer base, facilitating global expansion. Stripe’s system automatically detects the customer’s location and presents the most relevant payment options, enhancing the checkout experience.

Pricing Structure and Transaction Fees

Stripe employs a pay-as-you-go pricing model, charging 2.9% + 30¢ per transaction. For international transactions involving currency conversion, an additional 1% fee is applied. Businesses with high-volume transactions can negotiate custom pricing packages, potentially reducing their overall fees.

To minimize transaction costs, businesses should consider optimizing their payment flows and leveraging Stripe’s features, such as dynamic currency conversion and localized payment methods. By doing so, businesses can not only reduce their processing expenses but also improve their international reach and customer satisfaction.

PayPal: The Trusted Name in Global Payments

PayPal

With its extensive global reach and versatile payment solutions, PayPal has become a go-to choice for businesses worldwide. As a trusted name in global payments, PayPal offers a range of services designed to facilitate international transactions.

Features and Capabilities

PayPal’s payment gateway is designed to cater to the needs of international businesses. It offers a range of features, including multi-currency support and local payment method integration, making it easier for businesses to operate globally. PayPal’s platform is also known for its security and compliance standards, ensuring that transactions are processed safely and in accordance with regulatory requirements.

PayPal provides a free as well as a paid version of their payment gateway: Payflow Link and Payflow Pro. The key difference between the two lies in their capabilities and the level of customization they offer. Payflow Pro, being the paid version, provides more advanced features and better support for high-volume merchants.

International Coverage and Currency Support

PayPal operates in numerous countries worldwide, supporting a wide range of currencies. This extensive coverage enables businesses to accept payments from customers globally, making it an ideal solution for international trade. PayPal’s currency conversion services also facilitate transactions in different currencies, although this comes with a currency conversion fee.

Pricing Structure and Transaction Fees

PayPal’s pricing model includes a standard fee for domestic and international transactions. For international payments, PayPal charges a cross-border fee of 1% and a currency conversion fee of 2.5%. The standard transaction fee includes a percentage rate based on the transaction amount, plus a fixed fee per transaction. For example, each transaction incurs a fee of $0.10. Businesses can optimize their PayPal implementation by understanding these fees and choosing the most cost-effective options for their needs.

For high-volume international merchants, PayPal offers volume-based discounts and enterprise pricing options. These can significantly reduce the cost per transaction, making it more economical for businesses with a large volume of international transactions.

Adyen: Enterprise-Level Global Payment Processing

Adyen

In the realm of global payment processing, Adyen has emerged as a leader, offering enterprises a comprehensive suite of payment solutions tailored to their complex needs.

Features and Capabilities

Adyen’s platform is designed to handle the sophisticated payment requirements of large international businesses. It offers a range of features including advanced fraud detection, multi-currency support, and integration with various e-commerce platforms. This enables businesses to process transactions efficiently across different regions and currencies.

The platform’s flexibility is one of its key strengths, allowing businesses to customize their payment flows according to their specific needs. Whether it’s through APIs, plugins, or other integration methods, Adyen ensures seamless payment processing.

International Coverage and Currency Support

Adyen supports a vast array of payment methods and currencies, making it an ideal solution for businesses operating globally. With coverage in over 190 countries and support for multiple currencies, Adyen facilitates international transactions with ease.

Pricing Structure and Transaction Fees

Adyen employs an interchange++ pricing model, which differs from the blended pricing models used by many competitors. This model involves a fixed processing fee of $0.13 USD per transaction, combined with a variable fee based on the payment method. For instance, an ACH Direct Debit payment costs $0.13 + $0.27 USD, while Union Pay costs $0.13 + 3%. This transparent pricing structure allows businesses to understand their costs clearly.

Adyen’s pricing varies by payment method, region, and transaction type. The company also offers volume-based discounts for large international businesses with high transaction volumes, making it a cost-effective solution for enterprises.

To optimize their payment mix within Adyen, businesses should consider the types of payments they process most frequently and adjust their strategy accordingly. By doing so, they can achieve the most cost-effective processing while maintaining high authorization rates.

Razorpay: Comprehensive International Solution

Razorpay

Razorpay is one of the leading online payment gateway providers, offering a wide range of payment solutions for businesses of all sizes. Founded in 2014 by Harshil Mathur and Shashank Kumar, Razorpay quickly gained popularity due to its easy-to-integrate API and seamless checkout experience. The platform supports a variety of payment methods, including credit and debit cards, net banking, UPI, and popular digital wallets.

Razorpay is known for its robust security measures, being PCI DSS compliant, and offering advanced fraud detection tools.

One of the standout features of Razorpay is its support for international payments, allowing businesses to accept payments from customers worldwide. RazorpayX, their neobanking platform, enables companies to manage their finances, automate payroll, and disburse vendor payments effortlessly. They also offer Razorpay Capital, a lending arm providing instant loans and cash advances to businesses. The platform’s dashboard is intuitive, giving real-time insights and analytics on transactions.

Razorpay’s subscription billing service makes it easier for SaaS companies and membership-based businesses to manage recurring payments. It also integrates with popular platforms like Shopify, WooCommerce, and Magento, making it a preferred choice for e-commerce. Additionally, Razorpay offers smart payment links and payment pages for businesses without a website.

Their competitive pricing, usually around 2-3% per transaction, is attractive for startups and SMEs. Razorpay’s powerful developer tools and documentation make it a favorite among tech teams. The company continuously innovates, recently introducing features like UPI AutoPay and Magic Checkout to boost conversion rates.

With a strong focus on customer support, Razorpay provides 24/7 assistance through multiple channels. It is trusted by major brands such as Airtel, Zomato, and BookMyShow. Razorpay is also expanding its footprint beyond India, aiming to become a global player in the fintech space. Its commitment to empowering Indian businesses digitally has made it a fintech unicorn and a role model in the startup ecosystem.

Checkout.com: Unified Global Payment Platform

Checkout.com

In the realm of international commerce, Checkout.com stands out as a leading provider of integrated payment solutions. With its comprehensive suite of payment services, Checkout.com caters to the diverse needs of businesses operating globally.

Features and Capabilities

Checkout.com’s payment platform is designed to offer a seamless payment experience across borders. Its features include multi-currency support, allowing businesses to accept payments in various currencies, and local payment method integration, enabling businesses to cater to local preferences. The platform also emphasizes security and compliance standards, ensuring that transactions are processed securely and in accordance with regulatory requirements.

The platform’s capabilities extend to providing businesses with the tools they need to manage their payment processes effectively. This includes advanced reporting and analytics, helping businesses to track their transactions and make informed decisions.

International Coverage and Currency Support

Checkout.com offers extensive international coverage, supporting businesses in multiple regions and currencies. This global reach allows businesses to expand their customer base beyond geographical boundaries. The platform supports a wide range of currencies, facilitating cross-border transactions and simplifying the payment process for international businesses.

Pricing Structure and Transaction Fees

Checkout.com adopts a flat-rate pricing model that is quote-based, tailoring rates to the specific business needs and risk category. This approach differs from the interchange++ model used by some competitors, potentially offering more predictable costs for international businesses. Factors influencing Checkout.com’s pricing include industry, geographic focus, transaction volume, and payment method mix.

During the pricing consultation process, businesses can expect a personalized assessment of their payment needs. To prepare, businesses should have a clear understanding of their transaction volumes and payment processing requirements. Checkout.com’s transparent fee structure eliminates hidden costs, and businesses can optimize their payment strategy within the platform to achieve cost-effective processing while maintaining high authorization rates.

Comparing Online Payment Gateways for International Businesses

When expanding globally, businesses must carefully compare online payment gateways to ensure seamless transactions across borders. The complexity of international payment processing demands a thorough evaluation of various gateways to determine which best suits a company’s needs.

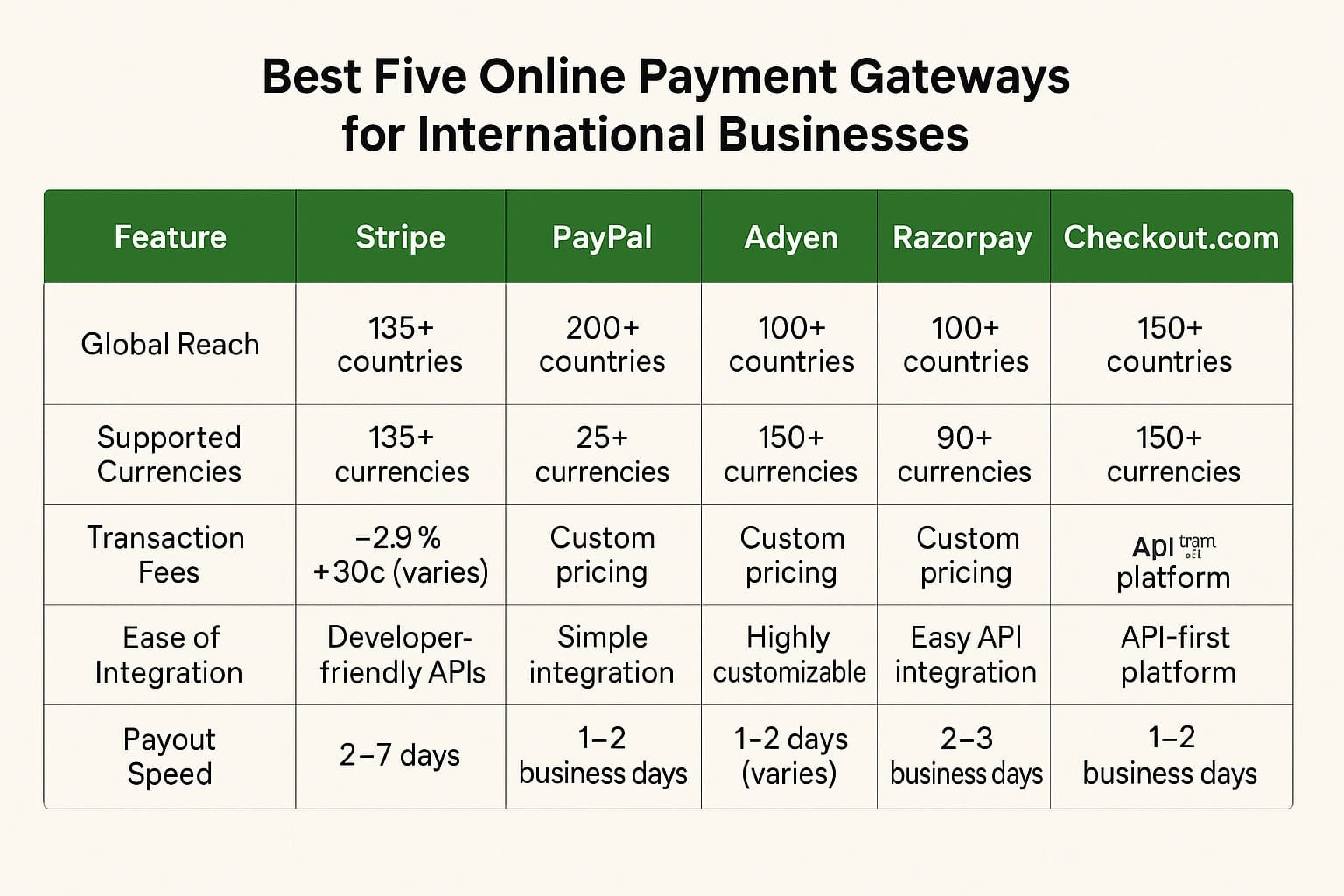

Feature Comparison Chart

To make an informed decision, businesses should examine the features offered by different payment gateways. A comparison of key features such as multi-currency support, local payment method integration, and security standards can help identify the most suitable gateway. For instance, a feature comparison chart might reveal that gateways like Stripe and PayPal offer robust multi-currency support, while Adyen excels in local payment method integration.

The chart below illustrates a comparison of the discussed gateways:

- Stripe: Supports over 135 currencies, with advanced fraud protection and a developer-friendly API.

- PayPal: Offers widespread currency support and a trusted brand, but with higher fees for some transactions.

- Adyen: Provides comprehensive local payment methods and a unified commerce platform.

- Worldpay (FIS Global): Delivers extensive payment method coverage and robust security features.

- Checkout.com: Features a unified global payment platform with competitive pricing.

Performance and Reliability Factors

Beyond features, the performance and reliability of a payment gateway are critical for international businesses. Factors such asauthorization rates,transaction success rates, andfraud prevention effectivenesscan significantly impact revenue. For example, SaaS founders transitioning from Braintree often report higher payment failures outside their home markets due to differences in how Braintree connects to banks in various regions. Moreover, payment processors typically leave businesses fully liable for registering, filing, and remitting sales taxes globally, with potential hefty penalties for mistakes.

When evaluating gateways, consider the following performance metrics:

- Transaction processing speed across different regions and payment methods.

- Reliability infrastructure, including uptime guarantees and disaster recovery capabilities.

- Effectiveness in fraud prevention and the rate of false positives.

- Approach to handling payment failures and retries, impacting revenue recovery.

- Quality of customer support across different time zones and languages.

By carefully analyzing these factors, businesses can select a payment gateway that not only meets their current needs but also supports their future growth in the global market.

How to Choose the Right International Payment Gateway for Your Business

International businesses face a critical decision when selecting a payment gateway that meets their unique needs. The process involves careful consideration of various factors to ensure seamless transactions across borders.

Assessing Your Business Needs

To choose the right international payment gateway, businesses must first assess their specific needs. This includes understanding the types of payments they need to process, the currencies they need to support, and the regions they operate in. Payment gateway integration with existing business systems is also crucial.

Consider the volume of transactions, the average transaction value, and the need for multi-currency support. Businesses should also evaluate the level of customer support required and the potential for future growth.

- Identify the types of payments to be processed.

- Determine the necessary currencies and regions.

- Assess the need for integration with e-commerce platforms and accounting software.

Evaluating Technical Requirements

Evaluating the technical requirements of a payment gateway is equally important. This involves assessing the level of technical expertise needed for integration and the compatibility of the gateway with existing systems.

Businesses should consider the security features of the payment gateway, such as compliance with PCI-DSS standards, and the ability to support multiple payment methods. Scalability is also a key factor, ensuring the gateway can grow with the business.

Common Challenges with International Payment Processing

The landscape of international payment processing is fraught with challenges for businesses operating globally. Two significant hurdles include managing currency conversion and ensuring regulatory compliance across different jurisdictions.

Currency Conversion Issues

Currency conversion is a critical aspect of international payment processing. Fluctuating exchange rates can affect profit margins, and businesses must decide whether to charge customers in their local currency or the business’s base currency. Efficient payment gateways can help mitigate these issues by offering competitive exchange rates and transparent conversion processes.

Regulatory Compliance Across Borders

Regulatory compliance is another significant challenge. Businesses must comply with various regulations, including data protection laws, financial reporting obligations, and consumer protection laws, which vary by region. For instance, Stripe has high standards of compliance with licenses and certifications in the UK, US, and EU, demonstrating the importance of robust compliance measures in international payments.

Making the Best Choice for Your Global Business on Bizansy.com

Businesses expanding globally must prioritize selecting an international payment gateway. Consider your specific needs and target markets. Visit Bizansy.com for insights on optimizing your global payment strategy and expanding your international business capabilities.